The post will give you Small Business Accounting Software for Mac and PC. The new generation is now running towards developing small business to be self-employed. The eligible candidates for jobs are increasing gradually, and it is impossible to provide all of them a good job. So to fulfill their basic requirements, the youngsters are moving for small business. But we all know even managing small enterprise requires a lot of efforts.

- Best Accounting Software Mac

- Best Accounting Software For Small Business

- Apple Accounting Software Small Business

- Accounting Software For Small Business

- Mac Small Business Accounting Software

To take over management developers has programmed the best software which can regulate your entries, expenses reports, invoicing, bill payments and much more easily. The cloud-based software will link with your bank account to accept and pay money and make it simple for you. Different software is designed with a variety of features just give a moment and take a look.

we are happy to help you, submit this Form, if your solution is not covered in this article. Photo negative app for mac.

Nov 20, 2019 Small business owners do more than one job any given day. They wear lots of hats. Hence: 17Hats. This accounting software is a lot more than accounting software. It is a fully featured productivity suite for small businesses that includes bookkeeping features. Jun 04, 2020 The best small business accounting software fits within your budget, is easy to use, and allows you to track both income and expenses. The accounting software you choose should also include the ability to produce detailed financial statements and other reports to give you insight into the financial health of your business. May 20, 2020 Accounting software makes it easy for any small business to track income, outcome, and reduce costs in the long-term. Here we feature the best.

Best Small Business Accounting Software for Mac List

#1 – Intuit QuickBooks

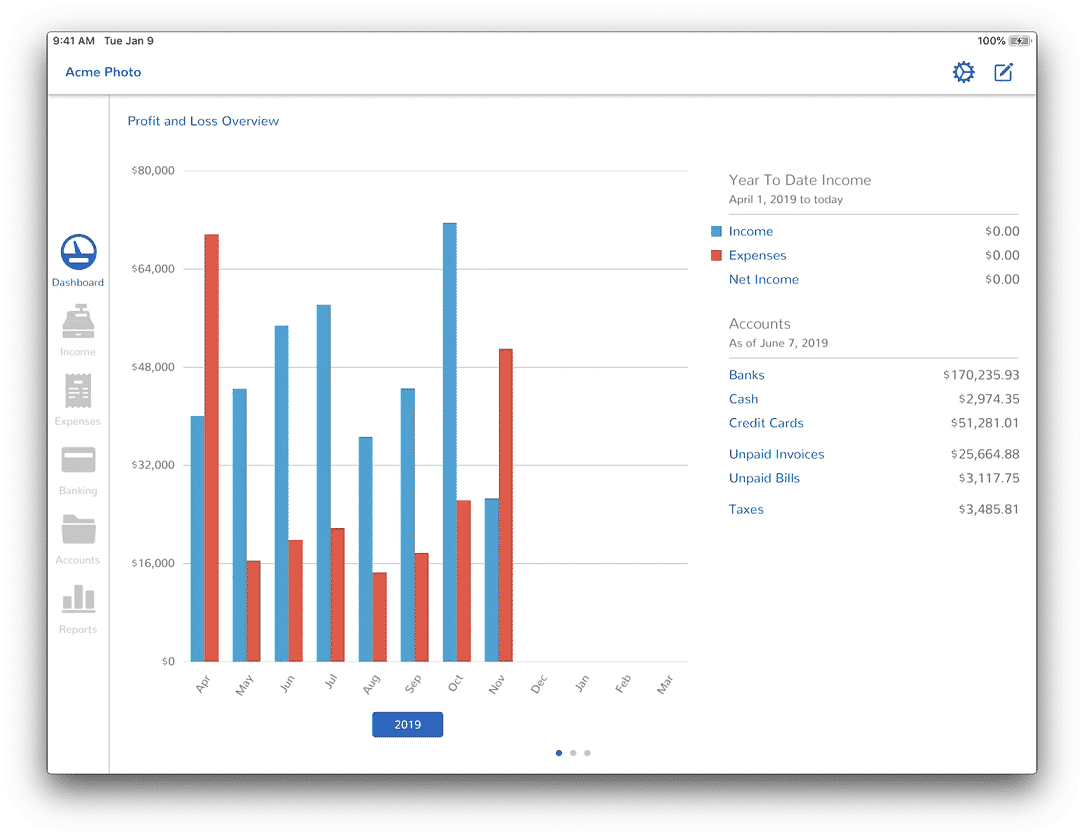

QuickBooksaccounting App for Mac and PC is designed with the simple interface even a new one can manage it. You don’t need to be expert in accounting it will organize everything for you at one place. When you link your bank account with QuickBooks, it will categorize transactions and will snap pictures of receipts, and the receipts will be stored in QuickBooks.

easily Make reports of expenses, profits and other purchases to track your progress and maintain money flow. Till now QuickBooks has delivered service to around 4.3 million customers globally, it’s time for you to try it.

#2- Xero

Xero is featured with popular and useful facilities that will change your life. This accounting software will manage all your activities related to your company from a desktop. It allows you to view all financial activities even on your iOS on the go, just get the app from App Store.

The smart features include easy invoicing, iPhone connectivity, track your sales and purchases, multi-currency support, pay bills, claim expenses and much more. If you are confused about this software, you can go for a free trial version for 30 days and take the experience of it.

#3- Freshbooks

If you are looking to hire an accountant to manage all your financial activities, don’t hire and waste your money. Because I have found the best alternative for you at a very low price, i.e., FRESHBOOKS. Step forward and make your invoice more professional and create a good impression on your clients.

All your data will be saved in the cloud so that you can access data even on your iOS device. Say goodbye to the diary to track your expenses, collaborate all your projects at one place, pay and receive money directly from FreshBooks and much more functions are available.

#4- Wave

If you are not earning well from your small business firm, wave accountant assistant is the best option for you. Wave is available free of cost and featured with almost all the facilities that you are getting in paid software.

You can customize your invoices and make more effective, track status of payments and bills to know when your bank account will receive money and try to accept payments through credit cards for your convenience. Manage your enterprise with no fees, no limits and more convenience.

#5- KashFlow

Keep your accounts up to date with KashFlow. Running a small enterprise is quite difficult because you don’t have enough capital and manpower to manage everything. That’s why KashFlow’s accountant program will do all these activities at your fingertips, and you don’t have to move anywhere and waste more money.

Get an overview of your account, Intuitive invoicing, reports, Payroll, HR and much more you can do with it.

#6- Sage One

sage One is the best and secure way to manage your small business and its account. The best part of this software is you can access anywhere anytime from different devices and continue your work on it. Even you don’t need any experience to use; it is super easy to use, collaborate and share.

Premium Support is Free Now

We are happy to help you! Follow the next Step if Your Solution is not in this article, Submit this form without Sign Up, We will revert back to you via Personal Mail. In Form, Please Use the Description field to Mention our reference Webpage URL which you visited and Describe your problem in detail if possible. We covered your iPhone 11 Pro, iPhone 11 Pro Max, iPhone 11, iPhone 8(Plus), iPhone 7(Plus), iPhone 6S(Plus), iPhone 6(Plus), iPhone SE, SE 2(2020), iPhone 5S, iPhone 5, iPad All Generation, iPad Pro All Models, MacOS Catalina or Earlier MacOS for iMac, Mac Mini, MacBook Pro, WatchOS 6 & Earlier on Apple Watch 5/4/3/2/1, Apple TV. You can also mention iOS/iPadOS/MacOS. To be Continued..

This platform is managing over 3 million business accounts globally over 30 years. So we can expect that the team behind saga One is well smart and expert with such a great experience of delivering services to its customers.

So, your business is booming. Congratulations. Now, bookkeeping is not the most fun part of running a business or a new startup, quite the opposite really, but still, a necessary practice to keep your expenses in check. In fact, bookkeeping and accounting will help you understand where all those funds are going, which expenses can be curbed, and how you can plan for the coming months or even years.

While traditional methods of bookkeeping are all but obsolete, robust software and apps have been launched in all shapes and sizes by the developers to help small businesses. This makes it difficult for small businesses, with limited budgets, to choose the right product. Let us help you with this guide on the best bookkeeping and best accounting software for small business.

Read: Best Business Card Scanner Apps for Android

Best Accounting Software for Small Business

1. Wave

Wave has gained a fan following in the small business community for providing a free and easy to use accounting solution. In fact, it was specifically built with small businesses in mind.

Wave is easy enough to use even if you don’t have any prior accounting knowledge. Wave will connect with your bank accounts (supports 10,000+ banks) to pull relevant data and there is no limit to the number of accounts or cards you can add. While you can manage accounts payable, Wave cannot make automatic payments to suppliers or service providers. You can manually mark entries as paid. All the payments that you accept from merchants will be noted and reflect in your books automatically. You can raise invoices and send them and when they are paid, mark them accordingly.

Want to manage employees and their salaries? There is Payroll where you can add all the info and Wave will take care of everything automatically. Although, Payroll feature is only available for U.S. and Canadian businesses.

Read: Best PayPal Alternatives

Finally, financial reports is what gives you a bird’s eye view of what’s happening in your business. Wave will automatically generate pie charts and graphs to help you understand cash flow and create a budget.

Wave Payroll is not free and fees begin at $4 per employee with a $35 base fee. Similarly, credit cards and bank payments will cost you 2.9% + $0.30 and 1% minimum respectively. Overall, Wave is one of the best free accounting software for small business. It’s also available for Android and iOS platform.

Pros:

- Free

- Targeted at small businesses

- Connect all accounts

- Reports, accounts, budgets

Cons:

- Can’t handle automatic payments

Get Wave (Free)

2. Freshbooks

With the advent of the Internet came the freelancers and the solopreneurs. They work alone with no need for employees. Think writers, bloggers, web designers, graphics designer, coders, mom and pop store owners and so on. Freshbooks was designed for you. Freshbooks will help you work with and raise bill for different clients easier. If you are a freelancer or small business owner and feel you are not ready for a paid tool yet, you can use thefree invoice generator by FreshBooks to create, download and print invoices. It also has an iOS app.

Another need for freelancers and solopreneurs is to keep track total billable hours. You can easily assign a dollar value to an hour and raise an invoice based on the number of hours you worked on the project. It comes with a number of invoice templatesso no matter which industry you are working in, there is a template for you. You can connect all your bank accounts and credit cards to pull data and create reports on the fly. Note that only profit and loss statements are supported in reports at the moment. You can also accept payment for invoices raised.

There is no direct support for payrolls because Freshbooks was not built for that. Similarly, there is no support for payroll either. If you do need these services, Freshbook integrates and works with Gusto app. Available on Android and iOS platform.

Plans begin at $15/month for 5 clients and go up to $50/month depending on the number of clients.

Pros:

- Freelancers and solopreneurs

- Connect all accounts

- Raise and manage invoice (very flexible)

- Payroll support

Cons:

- No support for accounts payable

- Limited support for financial reports

Download Freshbooks ($15/month)

Best Accounting Software Mac

3. Zipbooks

A lot of us begin with a simple spreadsheet and work our way through there. I used to monitor all my expenses and income using a spreadsheet too. It is free, easy to use, but lacks several features. Want something more but with fewer bells and whistles? Try Zipbook. Suitable for freelancers and small business owners.

The starter plan is free and can easily handle invoices, bills, and reports. You can create customer profiles. If you own more than one small business or work with multiple clients, Zipbook is good to go. Trading dollars for hours? You can track and assign billable hours. Like Wave, you can handle accounts receivables automatically. Unlike Wave, you can also manage account payables but manually. Tedious but works. Connect all your bank accounts to get an idea of your financial position using automatically generated reports. Zipbook is not available on Android for some reason.

While the Starter plan is good and free, Smarter plan at $15 will let you count billable hours, unlimited bank accounts, and collaboration team members. Sophisticated at $35 will let you add geo-tags to projects, add labels, secure document sharing, and bank reconciliation. Need a personal bookkeeper? Get the Services plan at $125.

Pros:

- Bank reconciliation

- Account Receivable

- Manual account payable

- Time tracking

- Connect all accounts

- Reports

- Personal bookkeeper

Cons:

- No support for Android

- Not all features free

Download Zipbooks (Freemium, Begins $15)

4. SlickPie

SlickPie, like other small business accounting and bookkeeping software mentioned in the list above, offers an easy to use interface for users with little to no experience in these matters. I feel SlickPie is more comparable to Wave as it is free to use and offers many of the same features.

There is no limit to the number of users or projects that you can manage with SlickPie, or even businesses. Connect all your bank and credit card accounts to generate reports, and track receivables with the aging report. Unlike Wave, SlickPie lets you track bills payable but manually. This works similar to ZipBooks where you can send and mark bills manually. You can accept payments online although for free bank fee.

SlickPie is available on Android and iOS platform and is available for free but limited to 10 company accounts. Upgrade to Pro plan at $19.95/month to add up to 50 clients.

Pros:

- Easy to use

- Connect bank accounts

- No limits on projects, accounts, invoices

- Tracks bills payable manually

- Cross-platform

Cons:

- No cash flow statements

Get SlickPie(Freemium, Begins $19.95/month)

5. GnuCash

Worried about sharing your financial details and bank statements with others? This is why a lot of people still use excel sheets and other offline tools. You could consider using GnuCash which is an open-source bookkeeping and accounting app for small businesses. Your data belongs to you.

GnuCash comes with the ability to create and run reports but if you are a coder or a developer, you can create your reports by altering the source code. The community is large and active so you will find help in the forums too. The only app in the list that is capable of running cash flow statements. On the downside, you cannot add more than 1 user which is limiting.

You can create invoices, assign clients, and track receivables easily. With cash flow in mind, GnuCash will let you manage accounts payable, run aging reports and deduct payments to reflect cash on hand/accounts. With security in mind, GnuCash won’t let you connect your banks accounts, however, you can upload statements in the number of formats like QIF and OFX among others manually.

There is no iOS support, only Android, but GnuCash also works on Linux machines apart from Windows and Mac.

Pros:

- Free and open source

- Works offline

- Generate cash flow statements

Cons: E signature app for mac pro.

- No way to add bank accounts

- Limited to one user only

GnuCash (Free)

6. GoDaddy Bookkeeping

A lot of freelancers and online shops owners are working with eCommerce platforms like Amazon, Etsy, and eBay. This is where GoDadday Bookkeeping comes for small businesses comes into the picture. Apart from domain and web hosting solutions, these guys also provide bookkeeping services.

GoDaddy will connect with popular eCommerce merchants and pull in data to create necessary reports. You can create, mark invoices and also calculate quarterly taxes on the move. GoDaddy Bookkeeping is more suitable if you are operating in the US though.

There is no way to manage multiple projects or add multiple users. More suited for freelancers and solopreneurs working with the supported list of eCommerce platforms. A niche product, if you will. You can not only track billable hours but also mileage.

GoDaddy Bookkeeping for small businesses is available online and for Android and iOS devices. Starter plan at $4.99 is the cheapest. For $9.99, you can also calculate taxes and add bank accounts, and for $14.99 you can create recurring invoices. GoDaddy Bookkeeping offers one of the cheapest solutions.

Pros:

- Connects with eCommerce platforms

- Cross-platform compatibility

- Connect bank accounts

- Calculate taxes

Cons:

- Can’t add more than one project

Download GoDaddy Bookkeeping (Starts $4.99/month)

7. Quickbooks

No list of accounting and bookkeeping apps and software can be complete without Quickbooks which is owned by Intuit. One of the most popular and feature-rich bookkeeping solution that is scalable and suitable for both startups and large enterprises.

Usual features like connecting bank accounts, collecting payments, creating and tracking invoices and managing reports are all there. The first plan is Self-Employed targeted at freelancers and solopreneurs. You can’t pay bills or manage payrolls but accept payments and connect bank accounts. Costs $17/month.

Simple Start is for small businesses with no team or user access needs but need advanced financial reporting (20 types) and handles payroll processing. Still no support for accounts payable and limited bank and credit card accounts. Costs $20/month.

Essential Plan is where you can add users and share data and reports with others, manage payroll, and also accounts payable. It can also print checks and there are 40 types of reports to generate. I am not even sure what they can be! Costs $35/month.

Finally, there is the Plus Plan that is suitable if you have multiple products and inventory to track, need more users on-board, and create forecasts. Costs $60/month.

Pros:

- Less-expensive

- Scalable

- Cross-platform

- Connect bank accounts

- Track inventory, payables

Best Accounting Software For Small Business

Cons:

Apple Accounting Software Small Business

- None

Accounting Software For Small Business

Download Quickbooks ( begins $17)

Mac Small Business Accounting Software

Which is the best Accounting Software for Small Business?

There are many other solutions available in the market but they are either similar in nature to the ones reviewed above or aren’t bringing anything new to the table.

If you need an open-source solution because privacy is on your mind, try GnuCash. Not feature rich but will get the job done.

If you need a free tool that lets you do pretty much all the basic tasks like accept payments and create reports, try Wave or ZipBooks. Both are free and work amazingly well.

If you need a scalable solution with support for inventory and assets, try Quickbooks.

This product is a TWAIN-compliant scanner driver for Canon color image scanner. Canon CanoScan LiDE 20 for Mac. Kind of wish the software were a little less messy and 90's looking too. Canon U.S.A., Inc. Limited Warranty - (USA Only) The limited warranty set forth below is given by Canon U.S.A., Inc. ('Canon USA') with respect to the new or refurbished Canon-brand product ('Product') packaged with this limited warranty, when purchased and used in the United States only. Canon u.s.a.,inc. Makes no guarantees of any kind with regard to any programs, files, drivers or any other materials contained on or downloaded from this, or any other, canon software site. All such programs, files, drivers and other materials are supplied 'as is.' Canon lide scanner driver mac.

For freelancers or a solopreneurs, Wave and Freshbooks are better options.

And finally, if you are working with eCommerce giants, GoDaddy Bookkeeping is ideal for you.